Does Working At A University Qualify For Public Service Loan Forgiveness

If you've successfully completed a Ph.D., yous've already been through the gauntlet of years of research and graduate study. And so yous hustle to find a job in the super competitive labor market of academia. Since you lot've been through so much, you might equally well utilize Public Service Loan Forgiveness (PSLF) for college professors and other academic professions.

I wanted to be an economics professor in undergraduate until I got my barrel kicked by an Avant-garde Calculus math course my junior yr. Before I changed my career path, I had been looking at fully funded programs. I likewise had the adept fortune to come out of undergrad without whatsoever debt, too.

Not anybody is as fortunate. You might have needed to borrow to pay for undergrad fifty-fifty though your Ph.D. is covered. Perhaps your plan requires that you pay tuition, and then you lot're stuck with loans from undergrad and grad school. If you own 5 or half-dozen figures of pupil loan debt and take a Ph.D., this article is for yous.

To examine how to use PSLF equally a university professor, researcher, or college administrator, nosotros'll look at a variety of examples for federal borrowers. Hundreds of thousands of college faculty members could benefit from the PSLF programme.

Go credit for loan forgiveness while you're a teaching assistant or graduate banana

Most Ph.D. programs have some extended period of grooming where yous're making a low income. You might have a didactics assistant or graduate assistant job in the pure academic fields similar history, mathematics, or chemistry. In the medical world, at that place might exist a different structure similar a residency in veterinary medicine.

In many situations, you'll have four to five years of depression income without taking out new loans. Assume you earn $25,000 per year and owe $50,000 of federal Direct Loans from undergrad. If you utilize the Revised Pay Every bit You Earn programme (REPAYE), your monthly payments could exist equally depression as $47 a calendar month.

If your loans had an interest rate of 7%, and so you would as well receive an interest subsidy. The REPAYE plan covers one-half of the interest that your required payment does not cover. That means your almanac interest on the REPAYE plan in this case would be $2,090 a year instead of $three,500 a year if y'all used forbearance or deferment.

Keep in mind that the REPAYE program has no cap on payments. You might need to use the Pay Every bit You lot Earn (PAYE) programme instead so you tin can benefit from the max payment of the Standard 10-year program.

Your takeaway should be that if yous can consolidate your loans and become them onto the PAYE or REPAYE plans while yous're making a low income, you should admittedly do this. Many college faculty and staff fail to do this and price themselves thousands of dollars.

Note that I've had some readers and clients tell me their university didn't want to sign off on their federal educatee loan repayment program certification forms during their grad school or grooming years. Basically, the part manager didn't desire to put his name to them being full-time employees.

If you run into this bureaucratic resistance, explain they aren't committing to anything or giving you benefits. They are just confirming you're a total-time employee of the university, which is true.

How postdocs tin can pay student loans too

It's not at all uncommon for a newly minted Ph.D. to spend a year or more as a postdoc somewhere to build their research skills. When I was in college, my roommate was finishing up 1, and he reminded me that postdoc pay is higher than grad school, but information technology'due south even so very low.

Federal student loans can always exist paid on an income-driven program. In the example I used earlier, if a postdoc with a $40,0,00 income had $50,000 of pupil debt at a 7% interest charge per unit, the REPAYE programme would allow him to pay $172 a month. That's yet very manageable.

The interest subsidy, in that case, would exist effectually $700 a year. That'southward not much, just it'due south still a nice do good to have in instance you go into the individual sector and need to refinance. The subsidy travels with you fifty-fifty if you leave academia.

You desire years of PSLF credit once yous earn a total professor salary

Whether you lot go into education, research, or administration, you will eventually earn wages that no longer classify as poverty level. For a history professor, you might earn only $60,000 to $lxxx,000 starting, while engineering professors might earn significantly more than that.

In well-nigh cases, if you built up years of credit to use PSLF while in grad school, you should be able to get a pregnant chunk of debt relief regardless of what your income ends up being.

To show this, pretend Rachel Chu went to an expensive liberal arts higher before she went to get her Ph.D. in economics and eventually get a professor at NYU. She had $70,000 of Direct Consolidation loans when she got her bachelor's degree.

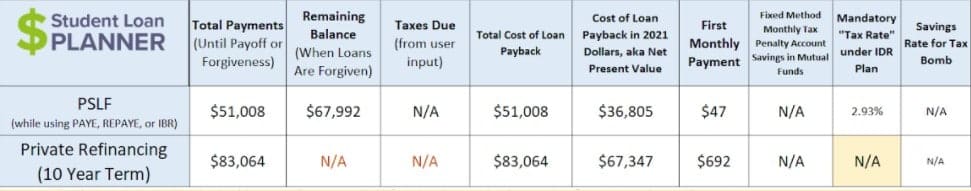

Rachel used the PAYE plan for her 4 consecutive years of grad schoolhouse. She made $25,000 per year while she was working towards her Ph.D. Her loan servicer, FedLoan, uses the prior year tax return when determining her payment. When she becomes a full professor, her income jumps up to $150,000.

She could simply refinance her debt to a x-yr stock-still rate at 3.5% and pay it off rapidly. Yet, what if she pursued the PSLF program since she's a full-time employee at a nonprofit organization (NYU)?

Even though Rachel makes twice as much coin every bit she owes as an economics professor, she still receives a substantial college professor loan forgiveness do good. Her payment caps out on the PAYE plan at $813 a month.

The difference betwixt refinancing and loan forgiveness is $32,056. That'southward a lot of money, even though she'southward probably not pain since she flies first class on Singapore Air Lines ( Crazy Rich Asians joke ).

Loan forgiveness for college professors who borrowed to encompass your Ph.D.

Some programs ask yous to pay tuition during your Ph.D. I've had several clients owe more than $200,000 in student loans even though they completed advanced educational activity and hold professor positions.

I would think long and difficult about attending a Ph.D. program that wouldn't fund your position. But if you're already in the debt, you need a plan every bit in that location is no utilize crying over spilled milk.

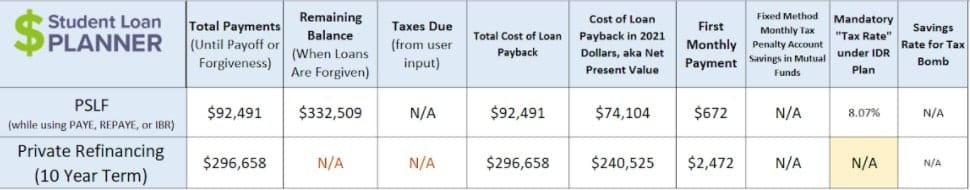

Pretend Phillipe owes $250,000 at a seven% interest rate. We'll assume he went to some professional blazon school plan before he obtained all the credentials necessary to get a professor.

If y'all borrow while you're in schoolhouse, y'all won't be able to claim any of that time towards the PSLF plan. Let'south assume Phillipe graduated and went straight into a $100,000 a year job equally a professor to see if loan forgiveness could help him.

Phillipe could salvage over $200,000 by using loan forgiveness as a college professor instead of paying his loans back. Since this savings is over ten years, that's equal to almost $xx,000 more than per twelvemonth of take-home pay that he would need to receive in a private sector job. After adjusting for taxes, this would probably amount to roughly $thirty,000 per twelvemonth of salary.

Hence, if Phillipe could get a private sector task at $130,000 or an bookish job at $100,000, he would be indifferent betwixt the two from a financial perspective. If he has a stiff want to have an bookish career, that would brand the decision piece of cake.

Researchers and higher administrators tin also utilize student loan forgiveness programs

What if yous're not tenured faculty but y'all still concord an advanced Ph.D. level instruction with a lot of debt? Good news: you can qualify for PSLF and benefit from the program.

The just eligibility requirements for PSLF are that you work full-time for a nonprofit 501(c)3 entity while making 10 years worth of qualifying payments on an income-driven repayment program like REPAYE or PAYE.

But does your employer qualify for PSLF? If you work in a lab doing experiments on mice as a university researcher, you qualify for PSLF, too. If you're an Assistant VP of Student Diplomacy, y'all qualify too. You lot just need to brand sure yous work directly for a government agency or nonprofit employer to authorize.

That said, if you take not-qualifying loans and already brand six figures, you won't exist able to benefit from loan forgiveness. For example, if y'all have FFEL student loans from before 2010 and you already make vi figures and owe less than $100,000, you should probably just refinance.

The central to loan forgiveness is having a low income initially that turns into a large income afterwards. Yous can also only have a steady high income that'southward notwithstanding lower than your debt.

Adjunct kinesthesia would merely be able to qualify for PSLF if they could be considered full-fourth dimension. The one loophole that exists for office-time university employees is that you tin piece together multiple office-time jobs to reach 30 hours a week at nonprofit employers to qualify, likewise. Some adjunct professors might need to endeavor to authorize through this back door.

Is a Ph.D. worth it financially with educatee debt?

You shouldn't practice a Ph.D. if your goal is to increase your income. There are plenty of better ways to make money than publish original inquiry and spend half a decade afterwards higher furthering your educational activity.

However, when you finish up your advanced education, y'all might take debt that'due south getting in the way of your life and career goals. With the PSLF program, y'all can obtain loan counterfoil as a college professor, researcher, or ambassador.

As I've shown, way more people could do good from this than currently do. The default is to sign upwardly for forbearance or deferment during low-income years. But that'southward the worst matter you tin do. Furthermore, it could price you lot many thousands of dollars.

Here are some final tips if y'all have more than than a new car's worth of student debt:

- Consolidate everything as soon as you can (as long as you haven't made any income-driven payments).

- Send your loans to FedLoan and certify your loan forgiveness credit annually with this form .

- Sign up for the REPAYE programme if you owe a large amount of debt. Apply the PAYE program if you lot owe a relatively small amount compared to hereafter salary.

- Don't panic or bound ship to refinancing or full repayment until you know y'all won't receive loan forgiveness.

In that location are other loan forgiveness for college professors programs, such every bit the Faculty Loan Repayment Plan (FLRP) for qualified teachers at health profession schools. There's also dozen more than PSLF tips to rid yourself of pupil debt. But these are the main strategies you can use to pay less on your Ph.D. student loans as a university employee.

If you lot have farther questions, we'd beloved to make a custom plan for yous. Let us assist y'all relieve as much money every bit possible on your educatee loans.

Any advice or expert/bad experiences paying back student loans while in grad school or after? Let u.s.a. know in the comments!

Does Working At A University Qualify For Public Service Loan Forgiveness,

Source: https://www.studentloanplanner.com/use-public-service-loan-forgiveness/

Posted by: suttonyoule1997.blogspot.com

0 Response to "Does Working At A University Qualify For Public Service Loan Forgiveness"

Post a Comment